21st Amendment Brewery Calls for Lender Moratorium to Retain Brewery Staffs During Pandemic

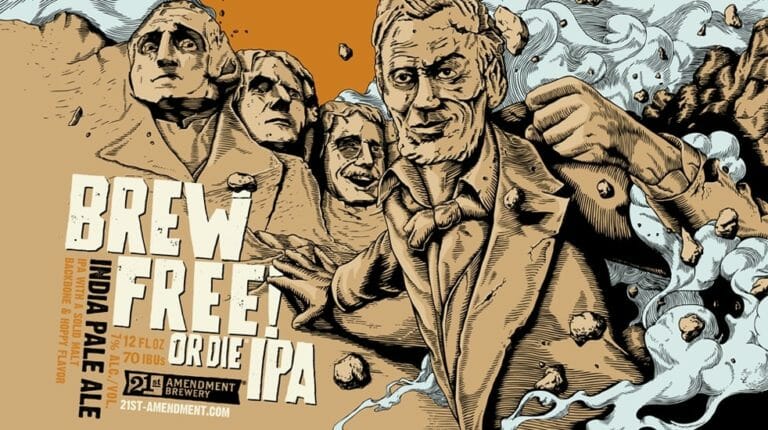

Photos via 21st Amendment Brewery Drink News craft beer

As breweries throughout the U.S. struggle to retain staff and continue paying them during a period of time when selling beer has become more and more difficult, one ray of light has been major commercial banks instituting moratoriums on principal and interest payments for small businesses. Several major banks, including Citigroup, JPMorgan, U.S. Bank and Wells Fargo, have already instituted such measures … but there are still other banking institutions out there that are expecting payment immediately.

Iconic Bay-area craft brewery 21st Amendment has a message for those banks, and for state and local officials: Give us a break, for the sake of our employees. The brewery has issued what they’re calling a “call to action,” urging state and local officials to advocate or instruct all lenders to follow the example of those four large banks. They’re asking for at least 60-day moratoriums on principal and interest payments for small businesses, including breweries.

That kind of leeway would allow 21st Amendment to continue paying its own employees, said Nico Freccia, co-founder and CEO in the statement:

“One month of bank principal and interest payments would cover 100% of our ENTIRE company’s current monthly payroll. And right now, with reduced and limited revenue, we need that money going into the pockets of our workers and our communities. Instead, we are faced with that revenue going into the pockets of the banks, in our case an international company owned by a foreign entity. All of us need to publicly call on commercial lenders now to voluntarily offer a moratorium for a minimum of 60 days on principal and interest payments during this crisis.”

21st Amendment’s bank is clearly among those that has not yet issued such a moratorium. Minority owned by New York’s Brooklyn Brewing, 21st Amendment Brewery is “celebrating” its 20th anniversary in 2020, but clearly not in the way they would have preferred. The company employs more than 110 people in the Bay area, but had to lay off or furlough all of its hospitality workers—around 60 employees—once the shelter-in-place order was made official.

“We have repeatedly asked our bank for deferral of principal and interest payments, which are due in just a few days,” said Freccia. “They have yet to offer any relief, specifically stating that while Congress wants them to be accommodating, there has not been any official guidance released for them.”

The banks, clearly, are not all going to choose to do this on their own. State lawmakers, now is the time to step in for the good of your constituents.