Introducing Endless Mode: A New Games & Anime Site from Paste

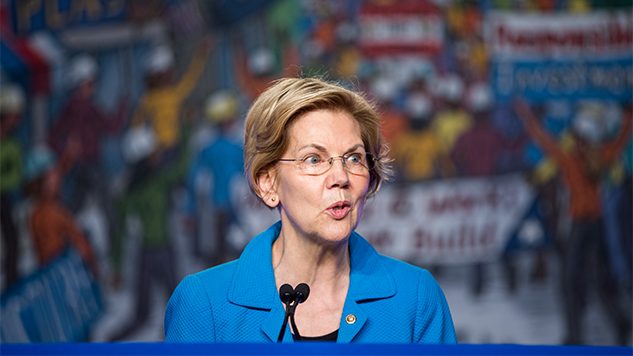

Sen. Elizabeth Warren, the current heavyweight in terms of policy in the Democratic race (check out our list of her 10 boldest proposals so far), has raised the bar even higher today with her plan to levy a 7% tax on corporations’ worldwide profits over $100 million.

The “Real Corporate Profits Tax,” which the Massachusetts Senator outlined in a Medium post on Thursday, would raise $1 trillion in government revenue over the coming decade. The Real Corporate Profits Tax would only affect 1,200 of the largest companies in the U.S., including our old favorite Amazon.

This straightforward plan of Warren’s is meant to keep corporations from dodging taxes through loopholes, as they are wont to do. As Warren explains:

We must try to fix our corporate tax code so that it generates more revenue and creates fewer economic distortions that simply reward powerful interests. I have fought to close loopholes that let big corporations pay less. And I strongly opposed the recent Republican tax bill, which has led to a huge drop in the amount of taxes we collect from corporations.

We need corporate tax reform, but we also need to recognize that enormous companies with armies of lawyers and accountants will always try to exploit any deductions and exemptions that remain. To raise the revenue we need—and ensure every corporation pays their fair share—we need a new kind of tax that big companies can’t get around.

The influence of corporate interests over our government, manifested in policies of deregulation and tax loopholes, has become exponentially more dire over the last few decades as their goals remain light-years away from the common good. This latest proposal is yet another reason why we need more Warrens and fewer O’Rourkes in the Democratic race.