How Two Brothers Managed to Almost Destroy the 20th Century Scotch Whisky Industry

Photos via Getty Images, Jeff J. Mitchell, Luke Sharrett, Creative Commons, Glenlochy.com Drink Features alcohol history

This piece is part of a series of essays on alcohol history. You can read more here.

In the late 1800s, the Scottish whisky industry was enjoying an unprecedented surge of growth. Distilleries across the isle were flourishing and expanding their capacities, laying down huge amounts of aging stock to keep up with the seemingly insatiable demand. Distilleries were going public on the stock market, and investment was rolling in from both large institutions and personal investors. Men young and old rushed to get involved in the whisky industry and its promise of quick profit.

Unfortunately, there was a little problem: That demand was a phantom, conjured by rampant speculation and shady businessmen. It was the emergence of a bubble that would pop at the dawn of the 1900s, sending the scotch whisky industry into a death spiral that would take half a century to correct course. And a sizable chunk of the mess could be traced back to two exemplary con men: Robert and Walter Pattison. Together, these brothers and their business would become emblematic of scotch whisky’s fall from grace in the first half of the 1900s.

The Pattison Brothers: Rise of the Whisky Tycoons

Robert and Walter Pattison were raised in the world of business, eventually taking over the family firm, Pattisons Ltd., which specialized in dairy wholesaling. They were successful in this field, but the ambitions of the brothers knew no bounds. Both had a taste for the finer things, and they wanted to be where the money was.

And as it happened, the money was increasingly flowing in the direction of blended scotch whisky. The industry had been in an upswing in the last two decades of the 1800s, and investing in distilleries had become fashionable. Part of the upswing was related to the demise of the French brandy industry, whose grapes had been devastated by an epidemic of the parasitic phylloxera. With brandy supply drying up, the U.K.’s upper crust increasingly turned to blended scotch whisky as an alternative, which meant a boom environment began to develop, as investment drove both production and whisky prices to new highs. It was into this vacuum that the Pattison brothers stepped, ready to capitalize.

In 1887 the brothers made the jump, beginning their own blending and bottling business in scotch. They were successful almost immediately, floating the company on the stock exchange only two years later in 1889 for a profit around £100,000. Within a few more years, their appetite grew more voracious—why stick to blending when you can distill and age your own product as well? The Pattisons expanded into distilling in 1896, and spread their money all over the industry, acquiring significant shares in prominent distilleries such as Glenfarclas, Aultmore and Oban. They even bought a brewery, the Duddingston Brewery in Craigmillar. Their flagship product? The self-named Pattison’s Whisky.

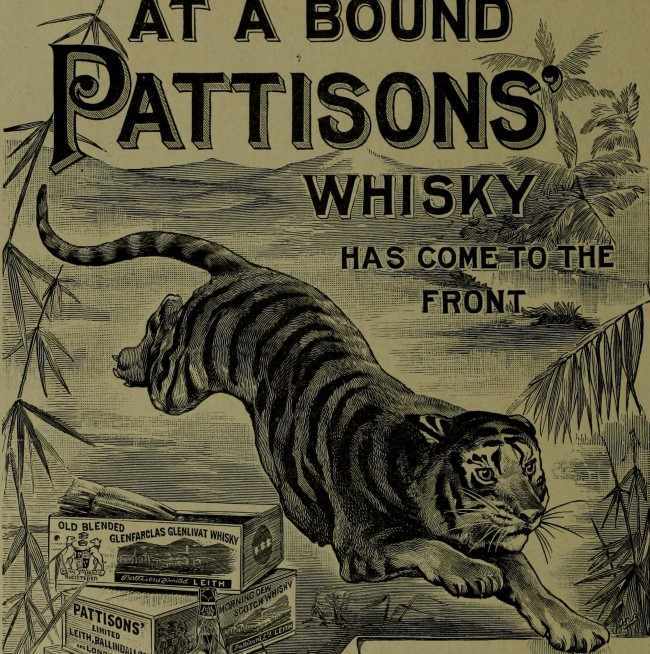

To promote their whisky, the brothers threw what was considered inconceivable amounts of money into advertising, establishing a new precedent for ostentatiousness. The £60,000 they spent on print ads and other forms of advertising in 1898? That comes to roughly £7.8 MILLION in modern coin, adjusted for inflation. And that expenditure included all manner of shameless publicity stunts, the most famous being the purchase of 500 African grey parrots, which were reportedly trained to repeat phrases like “Buy Pattison’s Whisky!” before being distributed to tavern and bar owners throughout Scotland. The brothers also developed expensive personal tastes, spending lavishly on “marble-clad offices” and country estates for themselves. They projected wealth and affluence to anyone who was watching.

At the same time, production of scotch overall was soaring to peak levels in the 1890s that would eventually prove to be far more production than was actually demanded, driven along by men like the Pattison’s outward appearances of profit and solvency. As put in The Making of Scotch Whisky by John R Hume and Michael S. Moss:

“Stocks were built up … to ridiculous levels. The annual increase in stock warehoused in Scotland rose from just under 2,000,000 gallons in 1891-2 to 13,500,000 gallons in 1897-98 and 1898-9 net additions to stock amounted to 40 per cent or more of total output.

In other words, distillation had gone into overdrive, but investors were still pumping more money into the industry—a classic speculative bubble. All it would take to bring things down was the failure of some of the industry’s most prominent figures … and that would come with the exposure of the Pattison’s web of fraud.

The Pattison House of Cards Collapses

No form of fraud or embezzlement proved too gauche for the Pattison brothers, and the depth of their criminal activity would come to light at the end of 1898. When the industry downturn began, the brothers could no longer cover their bills, and the resulting investigation made it clear that assets valuing more than £500,000 were unaccounted for.

As it turns out, Robert and Walter Pattison had been engaging in any number of shady activities. They routinely over-valued company property when negotiating for lines of credit. They sold and bought back their own whisky stocks, artificially inflating the valuation of those stocks to levels far higher than they should have been in reality. They kept their creditors and shareholders in the dark by paying them dividends from their operating capital, as in the style of a pyramid scheme. The whole thing was like an elaborate plate-spinning vaudeville number, needing constant influxes of new cash to keep the whole thing from crashing down. And as soon as the new lines of credit dried up, that was the end. In the resulting fallout, it was even revealed that the brothers’ whisky wasn’t all it was advertised to be, as they were apparently selling ‘raw Irish whisky of poor quality,” combined with real Scottish malt whisky, as “Fine Old Glenlivet,” according to contemporary reports.

The jig was clearly up, and in 1901 both Robert and Walter Pattison were convicted of embezzlement and fraud, both ultimately serving jail time. The closure of their businesses became known as the “Pattison Crash,” and its immediate vortex led to the bankruptcy of 10 other companies with which the brothers had done significant business. Whisky prices slumped at the same time as investors fled the industry, which was now revealed to be sitting on copious stores of aging product, without the demand to match.

For all their bluster, the Pattisons were paper tigers.

For all their bluster, the Pattisons were paper tigers.

Thus began a period where the entire industry suffered, being reduced almost to the brink of collapse over the next half century—during which time, not a single new distillery opened in the Scottish Highlands until Tullibardine in 1949. As an economic depression settled in the U.K., numerous factors made the period a uniquely difficult one for whisky, and the numbers reflect this.

Overall scotch whisky production had peaked at almost 36 million gallons in 1899, but by 1906 this number had fallen all the way to 24 million gallons. And even with the drop in production, the quantity of stock being held and aged continued to increase, thanks to relatively low consumption. Subsequently, a huge wave of distillery closures swept through the industry, which went from 159 scotch whisky distilleries in 1900, to only 15 of them by 1933, according to whisky historian Gavin D. Smith. It ultimately wasn’t until the post-war prosperity of the 1950s that scotch began the rebound that has carried the whisky industry to where it is today—although the fallout of the Pattison Brothers’ scandal was by no means the primary factor in the downturn, the reverberations of the bubble they contributed to were still being felt decades and decades later.

And ultimately, the Pattison crash helped to shape the major power players we still see in the industry today. Look no further than the Distillers Company Ltd., which in the turmoil went on to acquire the contents of various Pattison whisky warehouses for far under market value. Surviving the downturn of the coming decades, the Distillers Company went on to consolidate various distilleries and become the biggest player in Scottish whisky on a worldwide level. Today, we know them by a different name: Diageo.

It just goes to show that you never know how far the ramifications will stretch, when ambition exceeds sound business sense. The Pattison brothers burned brightly, flared out, helped to devastate an entire industry and re-shaped the whisky landscape forever.

Jim Vorel is a Paste staff writer and resident alcohol geek. You can follow him on Twitter for more drink writing.