Did Trump’s Treasury Secretary Hint at a Coming Economic Collapse?

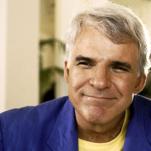

Photo by Chip Somodevilla/Getty

The stock market is getting absolutely demolished lately, and it sure seems like we are entering a downturn. It wouldn’t be a shock if we were on the cusp of a recession, since they come about every ten years, and it’s been a decade since the crash of 2008.

Speaking of 2008, the United States Treasury Secretary, Steve Mnuchin, released an absolutely bizarre statement about banking liquidity on Christmas Eve (a bank is liquid when it can easily convert assets to cash) that should send chills up the spines of those familiar with the Great Recession. Per Steve Mnuchin:

Secretary Mnuchin conducted a series of calls today with the CEOs of the nations six largest banks: Brian Moynihan, Bank of America; Michael Corbat, Citi; David Solomon, Goldman Sachs; Jamie Dimon, JP Morgan Chase; James Gorman, Morgan Stanley; Tim Sloan, Wells Fargo. The CEOs confirmed that they have ample liquidity available for lending to consumer, business markets, and all other market operations.

This is good news, but what makes it so harrowing is that there have been no reported liquidity issues with the banks, and so coming out and saying “all is well” when there’s no public reason to think things are not well is weird. Was there a 2018 liquidity crisis that no one heard of? What the hell is going on? What is this statement about?

The reason why this topic is so concerning is because banking liquidity was at the heart of the massive 2008 financial crisis. Lehman Brothers was founded in 1850, and it lasted through the Great Depression and countless economic downturns, but in 2008, the fourth-largest investment bank filed for the largest bankruptcy in American history after the endless amount of subprime mortgages they owned blew up their balance sheet. After a century and a half of being central to lending in America, Lehman Brothers faced a huge liquidity crisis, and disappeared in a week.

After Lehman collapsed, that kicked off a chain reaction that nearly destroyed the global economy. Because so much of our lending is concentrated among so few major banks, the entities who Lehman owed money to faced their own liquidity crisis, as Lehman’s bankruptcy destroyed assets and made them less liquid by removing debt payments they had anticipated. This dynamic is why congress passed the $750 billion TARP bill in 2008 (Troubled Assets Relief Program), because Wall Street proved themselves to be so interconnected that all it took was one bankruptcy to halt all lending amongst America’s largest banks.

Now, the day after Mnuchin sent out the “all is well, nothing to see here” statement, CNBC reported that despite Mnuchin’s headline being “the banks all confirmed ample liquidity is available for lending to consumer and business markets,” the call was actually not about liquidity. Per CNBC:

The U.S. Treasury Department had no concerns about liquidity whatsoever when Treasury Secretary Steven Mnuchin called the heads of the six largest U.S. banks on Sunday, a senior Treasury official told CNBC’s Sara Eisen on Monday.

The calls were intended to be a check-in with the executives on Federal Reserve Chairman Jerome Powell, the government shutdown, trade and the markets, the official said.

There is no reason to believe that the call was about anything relating to lending and liquidity, the official said. The message really should have been about the economy, which the bank CEOs said is looking quite strong, the senior official told CNBC.

“The message really should have been about the economy.”

Then why wasn’t it?

This is clear damage control, as someone from Mnuchin’s orbit (or Mnuchin himself) clearly reached out to the main financial news network to basically repudiate the statement that Mnuchin put out completely unprompted. Just prior to this CNBC report being released, CNN published an article citing people familiar with Mnuchin’s call to the banks, and it painted a picture of complete confusion on all sides. Per CNN:

The major bank CEOs who spoke by phone with Mnuchin were “totally baffled” by the session, according to a person familiar with the call.

“It was totally out of left field and an odd thing to do,” the person said, describing the timing of the call — on a Sunday before markets opened — as strange. All were taken aback by the public nature of Mnuchin’s tweet.

…

“This is the type of announcement that raises the question of whether Treasury sees problems that the rest of the market is missing,” Cowen & Co. analyst Jaret Seiberg wrote in a note to clients. “Not only did he consult with the biggest banks, but he is talking to all of the financial regulators on Christmas Eve. We do not see this type of announcement as constructive.”

Meanwhile, investors just yanked more money out of mutual funds than at any point since the financial crisis https://t.co/qwgBxzpWjN

— Joe Weisenthal (@TheStalwart) December 26, 2018

No one knows what the hell is going on, and that’s probably a big reason why the markets are tanking right now. Trump’s constant threats to infringe upon the sovereignty of the Federal Reserve aren’t helping, and the Christmas Eve crash began the moment this tweet was sent out.

The only problem our economy has is the Fed. They don’t have a feel for the Market, they don’t understand necessary Trade Wars or Strong Dollars or even Democrat Shutdowns over Borders. The Fed is like a powerful golfer who can’t score because he has no touch – he can’t putt!

— Donald J. Trump (@realDonaldTrump) December 24, 2018

But Trump has been attacking the Fed for a while now (because he owes money to his creditors on interest payments and every time the Fed raises rates, he loses more money), so this recent crash cannot be due just to our dipshit president. One of the longest bull markets ever seems to have finally run out of steam, and thanks to a bizarre statement from the Treasury, we can’t help but wonder if the cause of it is similar to what sent us into a spiral in 2008.

Jacob Weindling is a staff writer for Paste politics. Follow him on Twitter at @Jakeweindling.