Millennials Are Much Better with Money Than Baby Boomers

Photo by Hugh Pinney/Getty

Taxes are due today, and unlike our president, we know quite a bit about what is contained in our collective returns. People across all generations spend this season fretting over how much to pay Uncle Sam and what we will do with the money we get back from the federal government. Principal Financial Group shared some of their data with Paste, and revealed that 66% of all Americans expect to receive a federal or state refund this year. A little less than half of that group (47%) plan to save or invest their refund. The divide between the generation who plunged the world into debt and the one tasked to dig out of it is reflected in their figures of what we plan to do with our refunds.

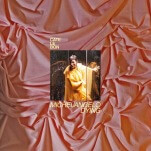

Data by Principal Financial Group

Timing no doubt factors into these numbers, as younger people have more debt and should be more focused on saving than their older counterparts, but reality doesn’t completely bear all of this basic logic out—as 79% of boomers have less than $5,000 in their savings account. In that case, they should be the ones much more focused on hoarding funds than those of us who are decades away from retirement, yet the numbers don’t reflect this as a bigger priority for boomers than it is for millennials.

The largest and most immediate shift is that millennials are driving an economy away from big-ticket items—demonstrated by Principal Financial’s measly 2% figure above. Many of us graduated into a market that lost 7.3 million jobs between September 2008 and February 2010—an unthinkable level of turmoil for anyone who did not live through the Great Depression. Baby boomers grew up in a thriving economy, so they have been less able to kick the habit of buying shiny and expensive things, while we never even got a chance to sample them in the first place. Peak-home buying years used to come in our 20’s, but for millennials, that average age is 45 according to Goldman Sachs. 15% of millennials say that it is “extremely important” to own a car, while double that amount—30%—say they “do not intend to purchase one in the near future.” The Uberization of the economy is a result of decades of profligate spending, and many of us are realizing that sharing items we do not consistently use is more efficient than buying them outright and watching them gather dust.

PwC’s Employee Wellness survey revealed that while 52% of employees are “stressed out” over their finances, 64% of millennial employees feel this pressure—likely because 42% of us have a student loan and 79% with these anvils around their financial necks say they have a moderate or significant effect on their ability to meet their fiscal goals. Despite our reputation for being uncoordinated airheads, millennials display far greater discipline when it comes to budgeting than our parents. According to TD Ameritrade’s Next Generation Research report, eight in ten millennials have budgets to track their spending, compared to six in ten boomers.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-