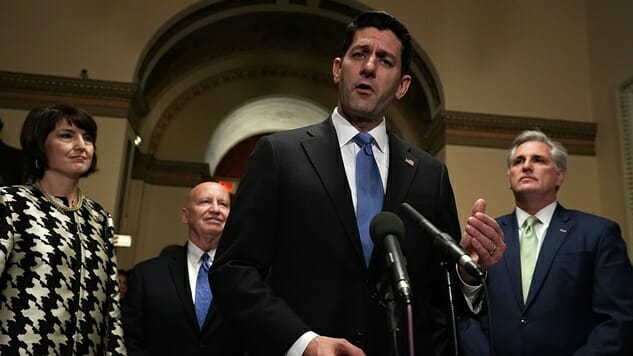

While You Watched Kavanaugh, House Republicans Passed Another Tax Cut. Here’s Who Benefits

The House just voted for a second round of tax cuts, expanding on the massive tax bill signed into law by Donald Trump last December. They’re calling it “Tax Reform 2.0,” and here’s what CNBC says about what it will accomplish:

Among other changes, the bills would make recently enacted tax cuts for individuals permanent, expand retirement and education accounts and create tax-advantaged Universal Savings Accounts.

But as Jeff Stein of the Washington Post noted, the Tax Policy Center is pointing to some very different outcomes, both in terms of how much it will add to the deficit and who it will actually benefit:

As Kavanaugh proceeds, House GOP just passed by 220-191 margin a second round of tax cuts estimated to cost $3.1 trillion in 10 years on top of $1.9 trillion cost of original tax law.

TPC estimates of how rich/poor benefit from GOP tax cut 2.0:https://t.co/DPA5jRkcPrpic.twitter.com/Li05IrMpkU

— Jeff Stein (@JStein_WaPo) September 28, 2018

music Watch Holly Bowling's Paste Session at Northlands Music Festival By Matt Irving October 13, 2025 | 2:37pm

movies NYFF: Park Chan-wook’s No Other Choice Nails the Joke, Then Keeps Telling It By Casey Epstein-Gross October 13, 2025 | 10:26am

books The Best New YA Books of October 2025 By Lacy Baugher Milas October 13, 2025 | 10:01am

music Madison Cunningham Finds Her Ace In the Hole By Caroline Nieto October 13, 2025 | 10:00am

music The 250 Greatest Albums of the 21st Century So Far: 250-201 By Paste Staff October 13, 2025 | 9:00am

movies The 100 Best Vampire Movies of All Time By Mark Rozeman and Jim Vorel and Paste Staff October 13, 2025 | 9:00am

movies The 35 Best Movies on Hoopla (October 2025) By Paste Staff October 13, 2025 | 7:30am

movies The 20 Best Movies on Starz By Paste Staff October 13, 2025 | 4:00am

movies The Best Movies on The Roku Channel By Paste Staff October 13, 2025 | 3:00am

movies The 50 Best Slasher Movies of All Time By Jim Vorel October 12, 2025 | 11:00am

movies Smiles and Kisses You Is a Sweet, Sad Tale of Loneliness and A.I. Delusion By Jim Vorel October 12, 2025 | 9:15am

tv The 20 Best Animated TV Shows on Netflix By Paste Staff October 12, 2025 | 8:00am

tv The 30 Best Horror TV Shows on Netflix By Paste Staff October 12, 2025 | 7:00am

movies The 25 Best Movies on Plex By Paste Staff October 12, 2025 | 5:34am

tv The Best TV Shows on Shudder By Jim Vorel October 12, 2025 | 5:30am

food, tv The 20 Best Food TV Shows and Documentaries on Netflix By Jim Vorel October 12, 2025 | 5:00am

music Time Capsule: The Juliana Hatfield Three, Become What You Are By Caroline Nieto October 11, 2025 | 12:30pm

music Best New Albums: This Week's Records to Stream By Paste Staff October 10, 2025 | 1:00pm

movies Jennifer Lopez Goes Full Musical in a New Kiss of the Spider Woman By Jesse Hassenger October 10, 2025 | 11:15am

music Jerskin Fendrix Polishes Grief With Ugly Indulgences On Once Upon A Time… In Shropshire By Vic Borlando October 10, 2025 | 11:00am

movies The 25 Best Werewolf Movies of All Time By Jim Vorel October 10, 2025 | 10:45am

music Flock of Dimes Lets Go On The Life You Save By Andrew Ha October 10, 2025 | 10:30am

music When I'm Good, I'm Very Good: Natural Born Losers Turns 10 By Devon Chodzin October 10, 2025 | 10:00am

movies Harris Dickinson’s Homelessness Drama Urchin Is Powerfully Honest British Social Realism By Brogan Morris October 10, 2025 | 9:15am

tv The 50 Best TV Shows on Netflix, Ranked (October 2025) By Paste Staff October 10, 2025 | 9:00am

tv The Best TV Shows on Amazon Prime Video (October 2025) By Paste Staff October 10, 2025 | 9:00am

tv The Best Free TV Shows on Tubi By Paste Staff October 10, 2025 | 8:00am

movies The 25 Best Movies On Demand Right Now (October 2025) By Josh Jackson and Paste Staff October 10, 2025 | 7:00am

tv The 50 Best TV Shows on Hulu Right Now (October 2025) By Paste Staff October 10, 2025 | 6:45am

movies The Best Movies on Peacock (October 2025) By Paste Staff October 10, 2025 | 6:00am

movies The 40 Best Movies on Tubi (October 2025) By Paste Staff October 10, 2025 | 5:30am

music Winnetka Bowling League – Full Session By Paste Staff October 9, 2025 | 4:21pm

music Watch a Paste Session from Matt Koma of Winnetka Bowling League By Matt Irving October 9, 2025 | 1:00pm

music Avery Tucker Goes Raw On Paw By Sam Rosenberg October 9, 2025 | 12:30pm

movies New Official Trailer: Jim Jarmusch’s Father Mother Sister Brother Explores Family, Distance, and Time By Audrey Weisburd October 9, 2025 | 12:11pm

music 10 Songs You Need to Hear This Week (October 9, 2025) By Paste Staff October 9, 2025 | 12:00pm

movies Somewhere Between Freedom and Forgiveness, Find Andrew Durham’s Fairyland By Audrey Weisburd October 9, 2025 | 11:15am

tv Boots Is a Queer Coming-of-Age Story That Marches in Place By Michael Savio October 9, 2025 | 10:16am

movies Kathryn Bigelow Ponders America At DEFCON 1 In A House of Dynamite By Jarrod Jones October 9, 2025 | 9:15am

music Hannah Frances Builds a Shelter Out of Nested in Tangles By Matt Mitchell October 9, 2025 | 9:00am