House GOP Unveils New Tax Reform Plan, Other GOP Members Already Against It

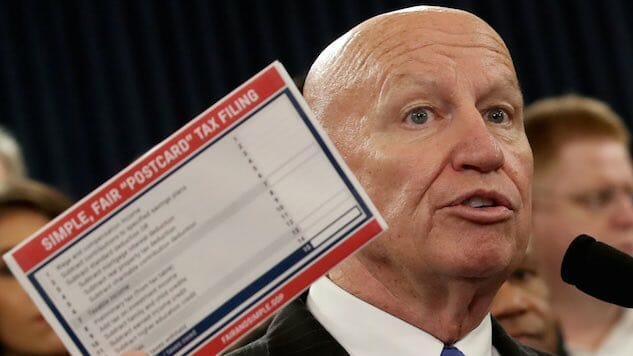

Photo by Win McNamee/Getty

Republicans in the House of Representatives today unveiled their plan for tax reform in a sweeping document that would constitute the biggest rewrite of the tax code in decades.

Politico reports that the tax reform features huge tax cuts, particularly to the corporate tax rate. It would also repeal the estate tax, “retain” 401(k) savings plans and “allow people to write off the cost of state and local property taxes up to $10,000,” in addition to introducing new family tax credits and limiting mortgage interest reductions. These new features water down tax breaks for homebuilders, which has led to the homebuilding market dropping at the stock market, CNN reports.

The plan was unveiled by Representative Kevin Brady, chairman of the House Ways and Means committee. Republicans cheered the plan, but Politico reports that many of them have no idea what’s actually in it.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-