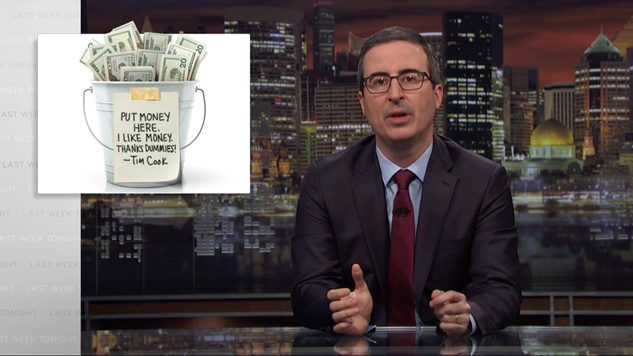

Watch John Oliver Explain Continued Corporate Tax Avoidance and the “Double Irish With a Dutch Sandwich”

Image via HBO/YouTube

Tax reform remains the only large-scale legislative win for the Trump administration 15 months into its tenure in the White House. It also remains the nucleus of many complaints hurled at the Republican-controlled government. The sweeping reworking of the American tax code greatly benefits the richest among us at the expense of the regular American worker, with the most to gain falling to corporations. The changes lowered the corporate tax rate from 35 percent to 21 percent while promoting that it would close loopholes that have allowed for gross examples of tax avoidance by corporations. While the former is now a reality our country’s financial managers must deal with, the latter isn’t as definite, a fact that John Oliver tackled in the latest episode of Last Week Tonight.

Chronicling the history of the shifting of assets, intellectual property and straight cash to foreign markets by American corporations, Oliver unpacks a scathing culture of greed that has been public record for a number of years. While the Panama Papers thrust the issue into a global spotlight, uncovering an incredible amount of evidence against companies and individuals alike, the moving of taxable income was public knowledge long before. The creation of the “Panama Scoot” strategy, in which American corporations registered their headquarters in Panama, in the ‘80s began a long and celebrated history of utilizing tax havens to avoid paying the government. As time went on, different nations and regions, ranging from the Caribbean to a small island in the English Channel, offered tax shielding to American corporations, ultimately resulting in 18 entities paying zero in taxes between 2008 and 2015.

The 2017 tax bill promised to bring these shifting profits back to the nation, but the policies and victories touted by the Trump administration do very little to actually correct the issue. While the government’s plan to bring back foreign-held corporate income under a one-time lowered tax rate sounds great, it has already been proven as an ineffective strategy. As Oliver explains, a similar act done in 2004 did nothing to create new jobs, with corporations spending “94 cents of every dollar” on stock buybacks and dividends, rewarding shareholders and corporate interests over workers.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-