Money isn’t Patriotic: Why Cryptocurrency is Taking Off

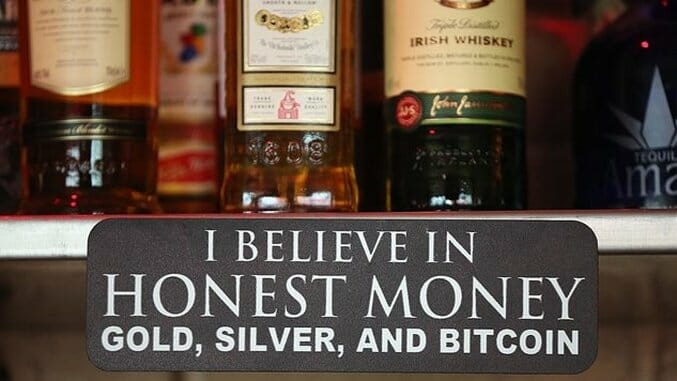

Photo by Sean Gallup/Getty

The 2008 global financial crisis is something of a dividing line between past society and present. Not only did it serve as a holy reckoning for our post-WWII financial sins, but it spawned many worldwide movements.

If you think Bitcoin is hard to explain, try to explain the current fiat system, and think again.

— imhotep256 (@imhotep256) August 6, 2017

The fiat system that we encounter today is not based on any physical commodity. The U.S. dollars sitting in your pockets and bank accounts have value solely because of the laws of supply and demand—nothing inherent within the product itself, and the rest of the world’s currency’s measure their value against our dollar. This is fundamentally different than the time when we pegged the value of the dollar to a physical amount of gold. The Federal Reserve now guarantees that U.S. dollars will be issued and accepted within its purview, and if need be, it will create more; therefore, dollars have value. That’s it.

But between overnight discount windows giving banks 0% loans and a whole host of other complicated financial tricks that seem to only aid those with armies of accountants and lawyers, our current financial system is left in the hands of a select few whose policies consistently benefit the Wall Street firms that many of that select few once worked for. Even though its supply is controlled by governments, money isn’t patriotic. It is a tool that can be used in a near infinite amount of ways by its user—many of which can hurt the issuing nation state as our global economy becomes more interconnected. Flaws have been exposed in our current financial model spanning all the way from Greece to the Nevada housing market, so it was inevitable that the age of software would introduce some digital infrastructure to this theoretical model—but with more checks and balances.

The crisis of 2008 exposed how top-heavy Wall Street firms have become and how few people control so much of the wealth (the central issue isn’t the 1%, it’s the .01%). So naturally, people began to think of ways to subvert this seemingly inescapable system, and thus, an anonymous person with the pen name Satoshi Nakamoto birthed Bitcoin, and a new form of currency arose. Out of natural curiosity, I initially followed its rise. However, as soon as I got some disposable income in my pocket, my interest in it became more than just a general inquisitiveness.

My Introduction to Cryptocurrency

My foray began in earnest last year, when I bought one Bitcoin at $420 per coin. JP Morgan had just come out with a forecast that predicted a poor year for the global economy, and because Bitcoin is like gold in that it acts as a bit of a hedge against the global economy (so if the economy goes down, Bitcoin/gold usually goes up), I decided that it was worth a short-term play—plus I liked the novelty of owning one coin. On June 23rd of last year, I sold my only Bitcoin at $570. Why June 23rd? Because that was the day of the Brexit vote, and polls indicated that it was likely that Brits would vote to remain. Because that would have been a good thing for the global economy, I figured that Bitcoin would take a nosedive after the vote.

**Slams head into desk repeatedly**

Bitcoin is currently trading at around $3,400. Making matters worse, I had the following conversation online with my friend a couple weeks before selling my Bitcoin (I swear on everything that is holy that this is 100% copied and pasted from my gchat history, I did not go through the trouble to conjure up this big of a self-own—I simply wanted to find the first instance of me hearing about Ethereum, and well, here it is).

Friend: assets value > digital currency. cuz if bitcoin gets to say $100B, that’s a blip in their assets. and if you want another cheaper coin to ride the upwave, ethereum has gone from $12 to $17 in a week. should mimic BTC but you can get more % out of it

Me: i have 0 interest in any cryptocurrency that isn’t bitcoin just because of what i learned writing that piece on it in 2014 (which was dumb and i was mostly wrong, but still). coinye will never leave my brain. that shit was going bananas right around when i wrote the article, and like 3 weeks later it was gone off the face of the earth.

Friend: yet you put a $1000 bet on the election? stop being so conservative, it’s just money.

Me: trump has the highest negative ratings of any presidential candidate ever, and even with an actual human being as their candidate, the GOP would still be underdogs in this election because the electoral college looks friendly to dems this year. all the numbers point to hillary being like a 5 to 1 favorite and the odds only had her as a 2.15 to 1 favorite. i just think there’s value there.

Friend: you bet her for prez??! thought you bet her as the dem candidate?

Me: no, POTUS. her odds for the dem nominee were batshit. like 1-10000. I got her at -215 for POTUS. plus, if trump wins, money is gonna be useless anyway. we’ll be using soup cans as currency

Friend: you’ll be using soup cans, the rest of us will be using bitcoin

First off, yeah, I know. I’m an idiot. Secondly, I am lucky that I have friends who are smart. If I had listened to my buddy and invested my thousand dollars in Ethereum instead of Hillary freaking Clinton, it would be worth over $16,000 right now, instead of the negative one thousand I wound up with thanks to the historic incompetence of the Democratic Party.

A lot has changed since that conversation, including my dismissiveness of all non-Bitcoin cryptocurrencies. After leaning on me for the better part of a year, my buddy finally convinced me to invest in Ethereum in February when it was trading around $13. As of this writing, it’s at $288. In the span of just five months, I have completely redefined my financial future around this new technology.

What is Cryptocurrency?

In short: it’s software. The same way that Windows is an operating system that allows you to run apps like Microsoft Word and Firefox, or how iOS serves as a platform to run apps like iTunes or Angry Birds on your iPhone, “cryptocurrency” enables developers to build a new generation of apps on a software platform that is based on the most innovative ledger technology in human history.

When we geek out over “cryptocurrency,” what we really mean is “blockchain technology.” It’s much more about the platform than it is the coin that fuels the platform. So what is blockchain tech? Per Don Tapscott, the Co-founder and Executive Director at Blockchain Research Institute:

“The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.”

The word “cryptocurrency” is a bit misleading, as these coins (aside from Bitcoin, which we’ll get to in a minute) aren’t really used as something that can be exchanged for goods and services. They’re software platforms, and the tokens that you can purchase are the oil that runs these platforms. I didn’t buy Ethereum, I bought ether—the coin that the Ethereum blockchain requires to run. Think of it like going to an arcade. You can’t play any of the video games without inserting a token into the machine, just like you can’t operate on a blockchain platform without spending its cryptocurrency first.

Blockchain technology is going to revolutionize the world. When you hear about the wave of automation coming to take our jobs, cryptocurrency is a central part of that. Accenture—one of the biggest management consulting companies on planet Earth—released a report stating that the world’s 10 largest investment banks could use it to cut their infrastructure costs by an average of 30 percent, which works out to about eight to twelve billion dollars in savings per year. If you’re in college and you want to become an accountant for an institution like Goldman Sachs: pick another lane, as blockchain technology is going to eliminate a wide array of jobs surrounding transaction processing and recording.

What is all this Bitcoin Drama About?

Bitcoin is in the news lately thanks to what many outlets are incorrectly calling a “Civil War.” As Bitcoin has grown from a genius white paper to a more mature technology, new challenges have emerged. The older version of Bitcoin is incompatible with the future that the demand is taking it towards, and the Bitcoin community accepted that the tech must be updated if Bitcoin is going to realize its true potential. Competing ideas from software developers to the miners who extract each coin to the investors speculating on it were all thrown into a chaotic argument until a consensus began to emerge. I won’t bog you down in the technical details (mainly because I don’t quite understand them myself), but a process called Segregated Witness (SegWit) emerged as the basis of the overall update.

Eventually, the debate came down to whether Bitcoin should go through a “hard fork,” as one proposal called for a second Bitcoin blockchain to be spun off on August 1st. This would be like Warren Buffett taking a private company owned by his publicly traded conglomerate, Berkshire Hathaway, and making that private company public. In that scenario, shareholders of Berkshire Hathaway would receive an equivalent amount of stock in the new public company. So in crypto land, if you own 10 Bitcoin; as of August first(ish), you also own 10 units of this new version of Bitcoin, called Bitcoin Cash.

The BIP91 update attempted to find something of a middle ground between some of these competing interests, and prior to the self-imposed 8/1 deadline on the Bitcoin update, around 90% of miners were using the BIP91 protocol, which many people assumed meant that there would be no hard fork (“miners” are what they sound like, they run digital mining operations to dig new coins out of the system while confirming existing transactions). The “Civil War” that has been played up in the media references the surprise split after this new update locked in. On August 1st, Bitcoin Cash was created, which copied and pasted the existing Bitcoin blockchain on to a new platform.

Bitcoin Cash is not Bitcoin, and it exists because enough holdouts pushed back against the SegWit update and created their own coin. Calling it a “Civil War” is hyperbolic given that a week before the creation of Bitcoin Cash, over 90% of miners were signaling that they were on board with the new system, and today it was announced that the BIP 9 update will lock Segwit in completely. In fact, there are plenty of programmers who argue that blockchain splits are a feature, not a bug of the ecosystem.

The reason that this update was such a big deal is not just because it was a large technological leap, but because Bitcoin is the lynchpin of the cryptocurrency ecosystem. It is the currency that most exchanges accept in return for purchasing other coins, and so it is effectively the U.S. dollar of the crypto world. A better Bitcoin is a rising tide that lifts all boats, including the boat of Bitcoin’s chief competitor. As to whether Bitcoin Cash will succeed, I honestly couldn’t tell you either way (I’m holding mine—or HODL, as they say in the native parlance), so I’ll let Paris Hilton sum up my extensive thoughts on that topic.

Never be afraid to be yourself. Remember, an original is always worth more than a copy.

— Paris Hilton (@ParisHilton) July 30, 2017

Bitcoin’s Chief Competitor

This article about Ethereum in The New York Times is what spurred me to go all in on this particular cryptocurrency. It is much newer than Bitcoin, and it is still far more speculative than it is real. Bitcoin has created an entire ecosystem of actual payments and companies, whereas Ethereum is mostly just a promise at this point. However, the unique technology that Ethereum brings to the table, combined with the companies backing that promise, make it Bitcoin’s first real challenger (not in the sense that it will replace Bitcoin, but that it may eat into its market share). On February 28th, thirty companies joined the Ethereum Alliance, highlighted by industry giants like JP Morgan and Microsoft. The companies that have followed looks more like a list of Dow Jones stocks than partners with a relatively unknown start up.

Here is just a sampling of EEA members: Accenture, BBVA, BP, BNY Mellon, Cisco, Credit Suisse, ING, Intel, MasterCard, Samsung, Santander, Scotiabank, and UBS. The EEA also includes entities like the National Bank of Canada and the government of Andhra Pradesh in India. This is not a drill, folks. This technology is entering your lives whether you care or not. IBM has even launched a competitor to Ethereum.

Marley Gray, the principal blockchain architect at Microsoft, said that “in every industry that we come across, Ethereum is usually the first platform that people go to.” The main reason why Ethereum is so popular is because it builds off of Bitcoin’s advances, and has its own strong selling point in its self-executing contracts.

What that means is, say that you and I bet $100 on the winner of the Super Bowl. We would set up a contract stating that if team X wins, I win $100—and you win $100 if team Y wins. As soon as team X wins the Super Bowl, the Ethereum smart contracts system automatically executes that transaction, and the money is immediately accessible to me. We deposit our funds at the time of agreement, and receive our money upon fulfillment of that agreement. Now take that principle and apply it to business, and you can see the wealth of opportunities that exist for people to build apps for almost any type of industry on top of this innovative platform.

So What Does This All Mean?

Firstly, that countries and businesses not only see this as an economic opportunity to innovate their products with world-changing technology, but they also view integration as a chance to mollify a threat to the existing order. There are plenty of Bitcoin fans out there who evangelize it as their super weapon to take on the international monetary system. This is not solely some quirky American libertarian phenomenon, and in fact, nearly all Bitcoin trades happen in China. In places where the currency is less stable, cryptocurrencies are becoming a legitimate store of value, and have worked as a check against the current government. Bitcoin has already greatly affected the struggling Argentinian economy, and many others in fledgling Latin American economies have leaned on it during trying times as well.

Once a digital currency has more value to people than the money produced by their government, you have broken a very important barrier in the international monetary order. Because the U.S. dollar underwrites the global economy, Americans are in a different place than those in Argentina or Venezuela, and the opportunity that Bitcoin has created is blinded a bit by the power of the dollar. The Chinese government listed blockchain tech in its “Thirteenth Five-Year” National Informatization Plan in 2015. The Russian government is expanding their banking system into the Ethereum platform every day. The world is adopting this technology as much out of necessity as choice. Meanwhile, American innovation in this space seems to be confined to the private sector.

A common line I’ve heard from a good handful of up & coming VCs I respect, paraphrased: “It’s hard to focus on things other than crypto.”

— Semil (@semil) July 31, 2017

We’re moving towards a more inter-connected future whether we like it or not. One of the main plot points on this season of Silicon Valley surrounded the effort to build a decentralized internet. That’s not some far-off fairy tale—that’s what Ethereum was built to do—and now it’s working with some of the largest companies in the world to try to figure it out. Blockchain technology is the missing piece in our accelerating advancement into the cloud. It is the solution to regulating the economies currently formulating in this ever-expanding digital space.

Once a community has agreed on a set of protocols, something resembling a nation state will inevitably emerge, no matter what space the community occupies. As Bali Srinivasan wrote in Wired from 2013:

What we can say for certain is this: from Occupy Wall Street and YCombinator to co-living in San Francisco and co-housing in the UK, something important is happening. People are meeting like minds in the cloud and traveling to meet each other offline, in the process building community – and tools for community – where none existed before. Those cloud networks where people poke each other, share photos, and find their missing communities are beginning to catalyze waves of physical migration, beginning to reorganize the world.

Will this ultimately end in a cloud country of our own, as Page, Thiel, and Musk propose in different ways? We can set this as a long-term goal, like the kind of dream that propelled so many millions to exit and come to America in the first place, but it’s unclear what the future holds. We do know this, however: as cloud formations take physical shape at steadily greater scales and durations, it shall become ever more feasible to create a new nation of emigrants.

Add autonomous and self-regulating software to underwrite this dynamic, and you clear one of the biggest hurdles to becoming an actual nation state: the ability to regulate an economy. It sounds crazy to envision a digital nation state, but keep in mind that there have been 26 new countries created since 1990.

Markets need rule of law, and rulers create constraints. Blockchains use code as law, and point the way towards true free markets.

— Naval Ravikant (@naval) August 7, 2017

Over the weekend, that same friend from earlier told me about a cryptocurrency named NEO (formerly called Antshares)—which is the first open source blockchain in China, is similar in its technology to Ethereum, and also partners with Microsoft (they also have a deal with the Chinese e-commerce giant Alibaba to manage an e-mail sorting system). So I rushed some funds into that venture as well, which is a strange situation for my financial future. I feel as if I have become one of the dreaded GLOBALISTS that Alex Jones and his Infowars cohorts speak of so derisively. But hey, I’m just playing the cards that I was dealt, and I understand the opacity of tokens fueling software platforms far better than the quirks and whims behind the movement of prices in the existing financial system, some of which have been revealed to be spurred by offers of day-old sushi.

Besides, the access that I have, the fees that I pay and the speed of the delivery of my coins far surpasses any product presently seen on Wall Street for the everyday investor. I can also see the status of my transaction in transit. Blockchain’s transparency provides much of the power behind its security.

I feel gross, cheering at every news story where I see the Kremlin moving to embrace my prized investment. I also feel weird rooting for its supposed Chinese brother—as I was sold on it mainly because the Shanghai municipal government seems to have given NEO its blessing—plus what the Chinese describe in their 2015 platform sure looks a lot like NEO. Much of my financial future now depends on the success of America’s adversaries.

Repackaging America’s giant real estate bubble as AAA-rated securities nearly destroyed the international financial system as we know it, and Donald Trump is a symptom of our refusal to deal with the core issues afflicting our society. Cryptocurrency is a direct response to the financial malfeasance perpetrated by the globe’s oligarchs, and it is the greatest innovation in the history of how humans transact with one another. Cryptocurrency as we know it is just the beginning of a massive sea change in how mankind will come to view money in the 21st century.

P.S. If you’re still having trouble wrapping your head around the overwhelming power of blockchain technology, here’s a thread from someone much, much smarter than me laying it all out.

Jacob Weindling is a staff writer for Paste politics. Follow him on Twitter at @Jakeweindling.